what is the sales tax on cars in south dakota

Mobile Manufactured homes are subject to the 4 initial registration fee. 4 Motor Vehicle Gross Receipts Tax Applies to the rental of motorcycles cars trucks and vans for less than 28 days and the rental of certain trailers for 6 months or less.

Motor Vehicle South Dakota Department Of Revenue

Can I import a vehicle into South.

. Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

Belle Fourche SD Sales Tax Rate. Sales tax in South Dakota is a combination of a 45 percent state tax and a general municipal city tax which varies from zero to two percent. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6There are a total of 290 local tax jurisdictions across the state collecting. The high sales tax states are. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1817 for a total of.

Car sales tax in South Dakota is 4 of the price of the car. Different areas have varying additional sales taxes as well. Noem said the proposed policy would be worth more than 100 million in tax cuts the largest in state history.

4 State Sales Tax or Use Tax Applies to all sales or purchases of taxable. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. The base state sales tax rate in South Dakota is 45.

Currently South Dakota is one of three states that impose a full. Blackhawk SD Sales Tax Rate. Essentially if the item.

Sales Use Tax. Box Elder SD Sales Tax Rate. Counties and cities can charge an additional local sales tax of up to 2 for a maximum.

California - 725 Indiana -. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and. Keep in mind that this is in addition to your registration.

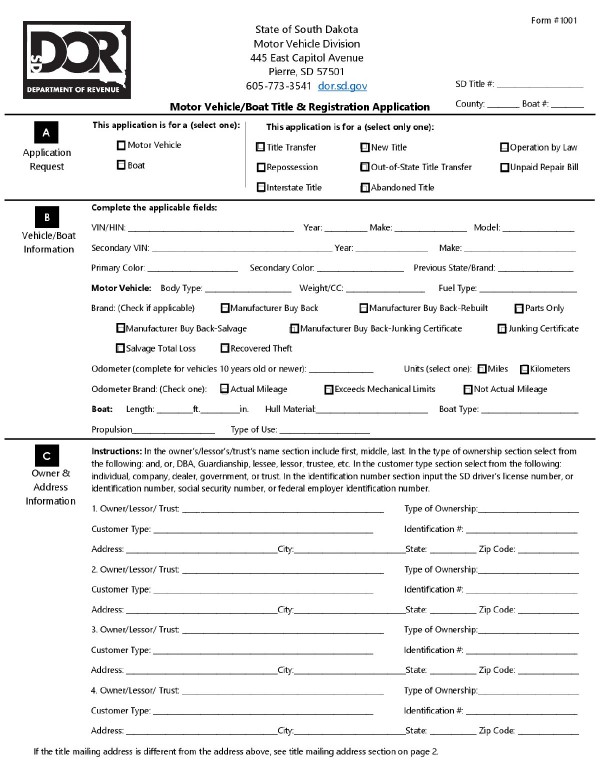

You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. In addition for a car purchased in South Dakota there are other applicable fees including registration title and.

South Dakota - 4 Virginia - 415 States with High Sales Tax The remaining states have the highest sales tax all 7 or above. Then youll have to pay a 4 excise tax based on the purchase price as well as the 10 title fee and any other charges that may apply. The South Dakota Department of Revenue administers these taxes.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. As of 2020 New York has a car tax rate of 4 plus local taxes whereas nearby Massachusetts charges 625 with some local rates even higher. In the state of South Dakota the laws regarding tax on shipping and handling costs are relatively simple.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. All car sales in South Dakota are subject to the 4 statewide sales tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Aberdeen SD Sales Tax Rate. The highest sales tax is in Roslyn with a. If South Dakota were to go from a 45 to a 5 sales tax to make up for the lost revenue of groceries then you would make the South Dakota sales tax code more.

Are shipping handling subject to sales tax in South Dakota. Find your South Dakota. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

How To Become A South Dakota Resident In 6 Easy Steps

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Historical South Dakota Tax Policy Information Ballotpedia

Used Car Dealer In Mitchell South Dakota Visit Vern Eide Ford Lincoln Today

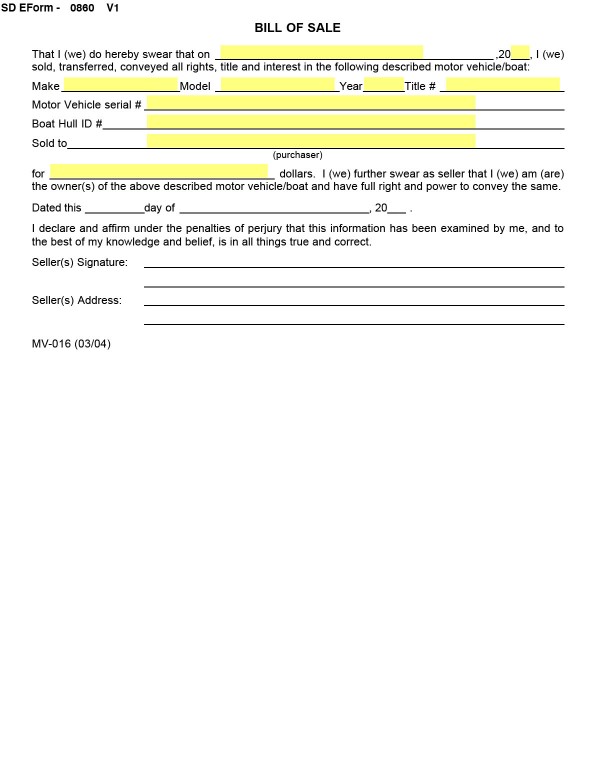

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Bill Would Eliminate Missouri Sales Tax On Older Cheaper Cars Missouri Thecentersquare Com

Government Faqs South Dakota Department Of Revenue

Bills Of Sale In South Dakota The Forms And Facts You Need

Our Adventure Becoming South Dakota Residents

How To Secure The Lowest Tax Rates On Your Next Car Carvana Blog

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Vehicle Title Tax Insurance Registration Costs By State For 2021

Form 1024 Download Printable Pdf Or Fill Online Seller S Report Of Sale South Dakota Templateroller

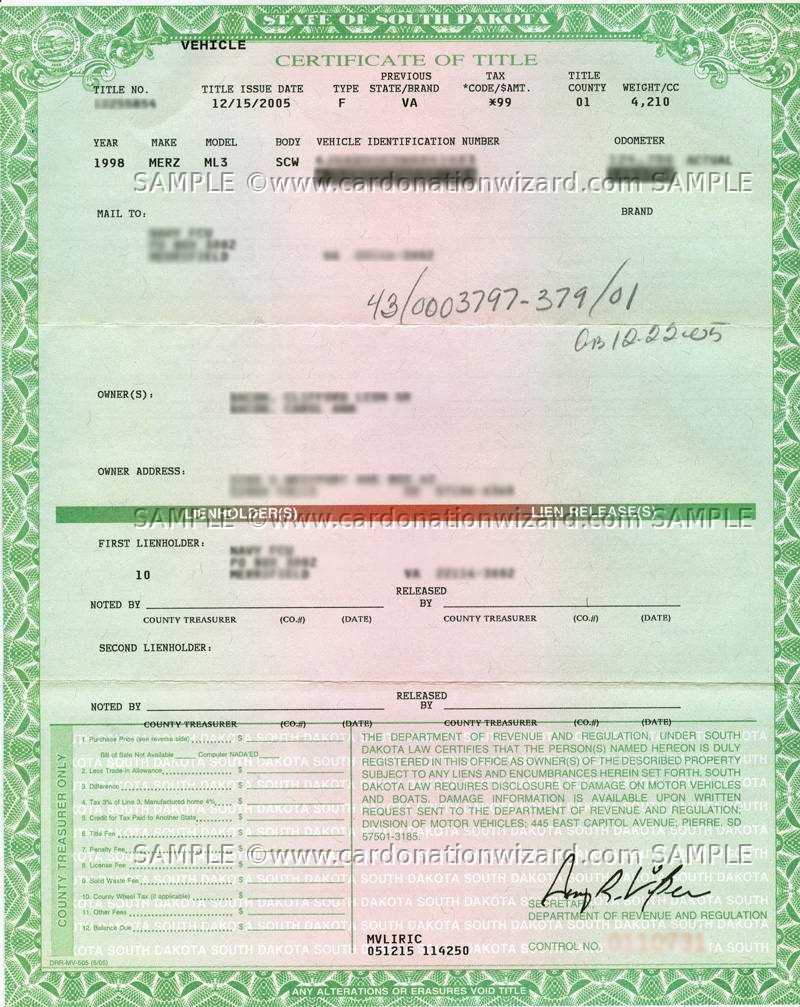

South Dakota Title Transfer Donate A Car In Sd On Car Donation Wizard

Sales Taxes In The United States Wikipedia

South Dakota Title Transfer How To Sell A Car In South Dakota Quick

Why Do So Many Rvs Have Montana And South Dakota License Plates Outdoorsy Com

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price