nj tax sale certificate

Creditor to take property without sale after a judgment of foreclosure. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA.

Gloucester City Tax Sale Information Gloucester City Nj

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

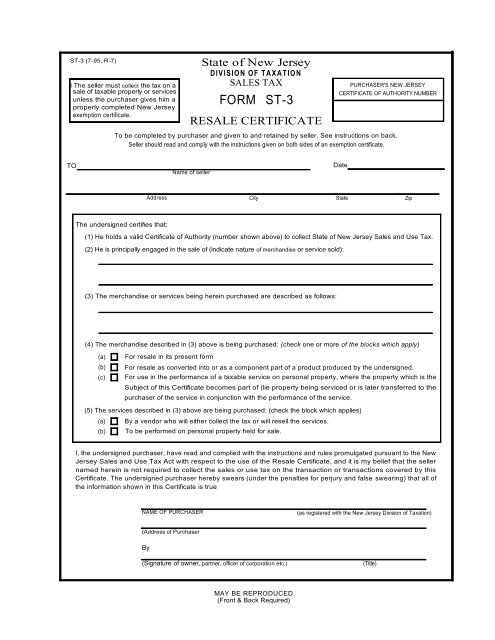

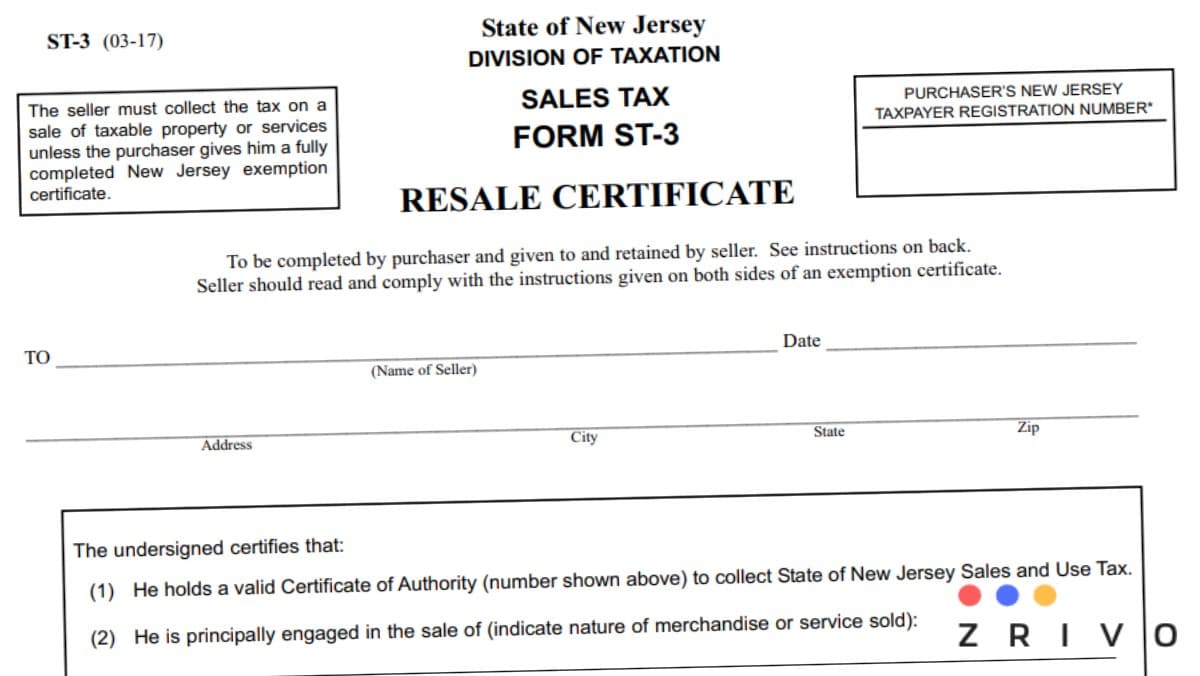

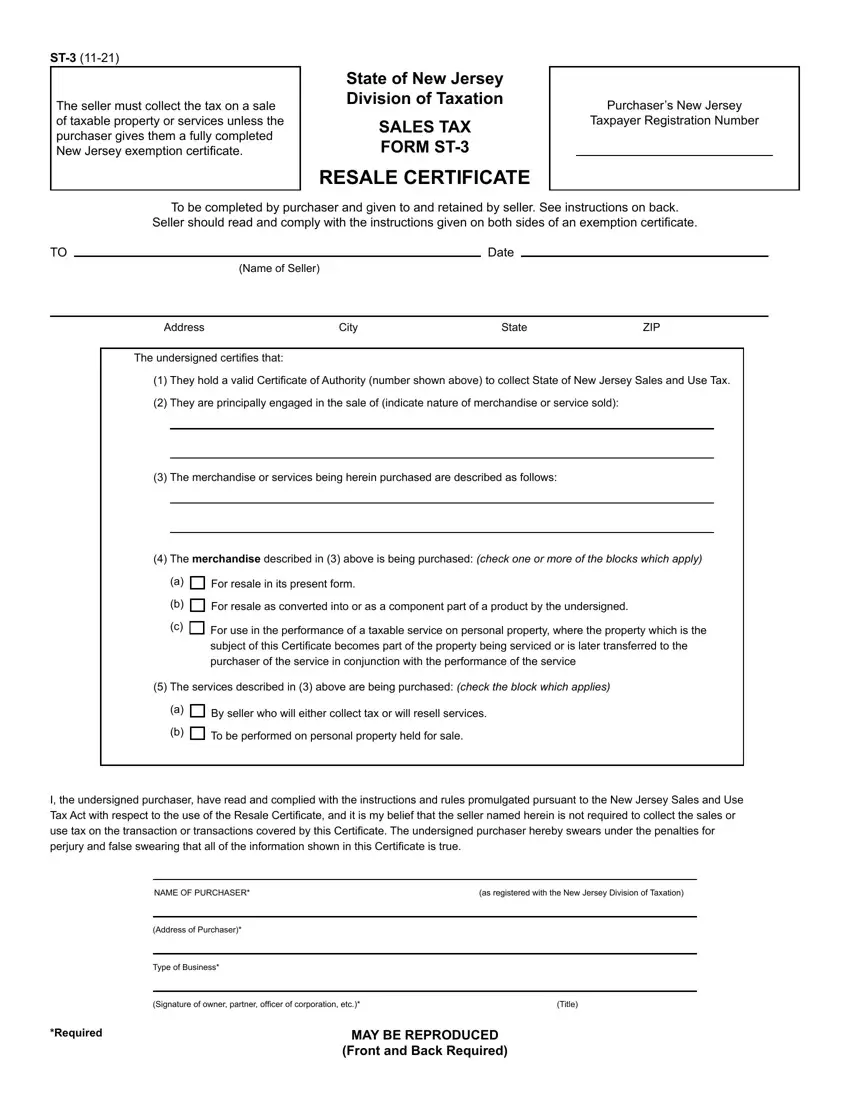

. What is sold is a tax sale certificate a. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. ST-3NR 3-17 State of New Jersey DIVISION OF TAXATION SALES TAX Form ST-3NR RESALE CERTIFICATE FOR NON-NEW JERSEY SELLERS For use ONLY by out-of-state sellers not.

Taxations Audit branch to administer the Liquor. 545-1 to -137 a. Princeton Office Park LP.

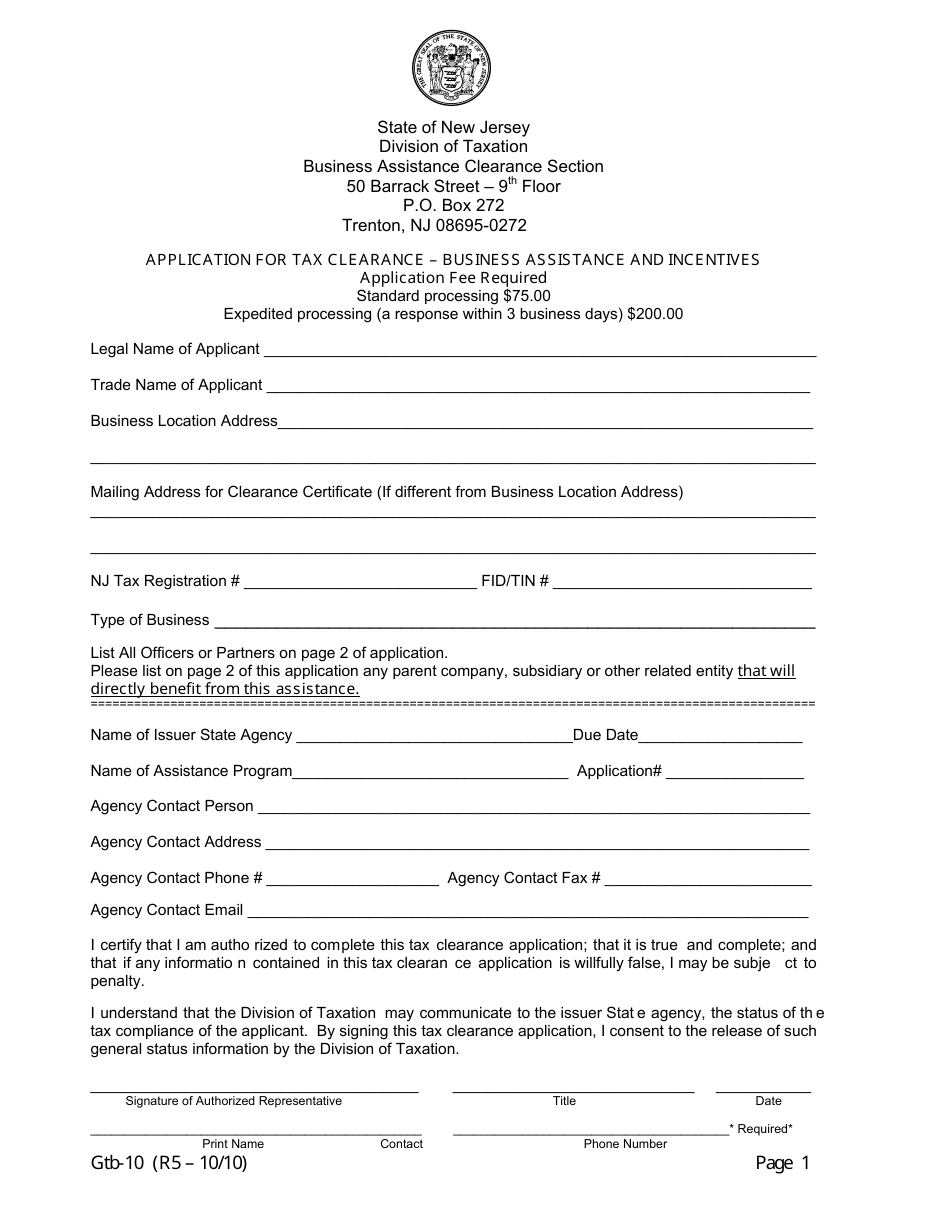

Once you have that you are eligible to issue a resale certificate. Due to changes in the New Jersey State Tax Sale Law the tax collector must create the tax sale list 50 days prior to the sale and all charges on that list together with cost of sale must be paid. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of.

In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales. Register for a NJ Certificate of Authority Online by filling out and submitting the State Sales Tax Registration form. New jersey tax lien sales 2021.

In New Jersey property taxes are a continuous lien on the. Ad Fill out a simple online application now and receive yours in under 5 days. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Tax Sale Certificates are recorded in County Clerks Office. Additional information about. By selling off these tax liens municipalities generate revenue.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. Tax sale certificate redemption new jersey.

30 rows Sales and Use Tax. What is sold is a tax sale. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

Once registered you must display your Certificate. This is commonly referred to as a sellers permit sales tax permit sales tax license sales tax number or sales tax registration. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

The tax rate was reduced from 7 to 6875 in 2017. Form SC-6 Salem County Energy Exemption Certificate. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and.

All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. Sales and Use Tax. Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges.

Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer. As with any governmental activity involving property rights the process is not simple. Methods of sale of certificate of tax sale by municipality.

Sales subject to current taxes. This certificate will furnish your business with a unique sales tax number. The first question that comes to mind is whether New Jersey has a statute of limitations that requires a tax sale certificate holder to file a foreclosure suit or be deemed to.

The New Jersey Supreme Court in In re. If you are served with a foreclosure complaint or wish to pursue a claim. Sales and Use Tax.

New Jersey Sales and Use. Ad New State Sales Tax Registration. Tax Exempt Resale Certificate Nj information registration support.

The sales tax certificate is obtained through the. The ClearanceLicense Verification Unit works with the. New Brunswick NJ 08901.

Effective January 1 2018 the New Jersey Sales and Use Tax rate decreases from 6875 to 6625. However if someone would like to purchase. State of New Jersey Division of.

SU-6 Sales Tax Exemption Administration New Jersey Sales Tax Exemption Certificates Corporation Business Tax Your business activity may require you to register for New Jersey. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. Monday - Friday.

Sale of certificate of tax sale liens by municipality. State Alcohol Beverage Commission. Taxations Field Investigations Unit.

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Form Gtb 10 Download Fillable Pdf Or Fill Online Application For Tax Clearance Business Assistance And Incentives New Jersey Templateroller

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Form St 3 New Jersey Fill Out Printable Pdf Forms Online

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Jared Cucci Director Of New Jersey Tax Lien Acquisitions And Servicing Bala Partners Llc Linkedin

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

Browse Our Image Of Holding Deposit Form Template Being A Landlord Proposal Letter Receipt Template

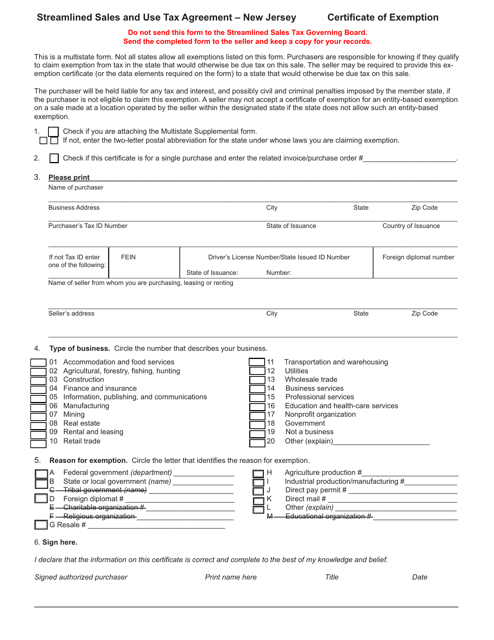

New Jersey Streamline Sales Use Tax Agreement Certificate Of Exemption Download Fillable Pdf Templateroller

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Minnesota Bill Of Sale Template Hennepin County